Orlando Housing Market Trends and Forecast for 2024

With demand outpacing supply and interest rates inching up, the Orlando housing market is leaning slightly towards sellers. However, buyers can still find opportunities, especially with the increase in inventory and pending sales. The housing market exhibits signs of vitality and resilience, with a surge in sales, a slight uptick in prices, and a dynamic interplay between supply and demand.

Orlando Housing Market Trends in 2024

How is the Housing Market Doing Currently?

The Orlando housing market witnessed a notable surge in activity as it welcomed the new year. According to the latest data from the Orlando Regional REALTOR® Association, overall sales experienced a significant increase of 26.5% from January to February. This spike propelled the number of sales to 2,174 in February, up from 1,719 in January. After a streak of eight months with declining sales, this rebound is indeed a noteworthy development.

Moreover, the median home price for February climbed to $377,000, marking an increase from $360,000 in January. This uptick comes after a period of three months where the median home price experienced a decline.

One of the key indicators of market vitality, pending sales, also saw a notable rise, increasing by 17.8% from January to February. This surge, coupled with a 7.8% increase in new listings during the same period, signifies a market that is picking up momentum as we transition into the spring homebuying season.

How Competitive is the Orlando Housing Market?

With interest rates edging up slightly from 6.5% in January to 6.6% in February, there’s a palpable sense of competition in the Orlando housing market. This uptick in interest rates, coupled with the surge in pending sales, indicates that buyers are actively engaging in the market, seeking opportunities despite the slight increase in borrowing costs.

Furthermore, the presence of distressed homes (bank-owned properties and short sales) in the market, while representing a small percentage of total sales, witnessed a 13.6% increase from January to February. This increase underscores the resilience of the market, with buyers exploring various avenues to secure properties.

Are There Enough Homes for Sale to Meet Buyer Demand?

While the Orlando area saw an increase in inventory by 4.5% from January to February, the supply of homes dipped to 3.95 months in February, down 17.3% from January. A balanced market typically boasts a six-month supply, indicating that the current market slightly favors sellers.

Despite the increase in new listings, the supply-demand dynamics suggest that while there are homes coming onto the market, they are swiftly being absorbed by eager buyers. This scenario underscores the need for prospective sellers to carefully consider market conditions and pricing strategies to maximize their returns.

What is the Future Market Outlook for Orlando?

As we look ahead, it’s essential to consider the momentum and momentum of the market. With pending sales on the rise and interest rates holding steady, we anticipate another active sales month in March. The spring homebuying season traditionally breathes new life into the market, and with inventory levels gradually increasing, buyers can expect more options in the coming months.

However, it’s crucial to monitor external factors such as economic indicators and regulatory changes that could influence market dynamics. Nonetheless, the current trajectory suggests a healthy and resilient market poised for continued growth.

Orlando Housing Market Forecast 2024 and 2025

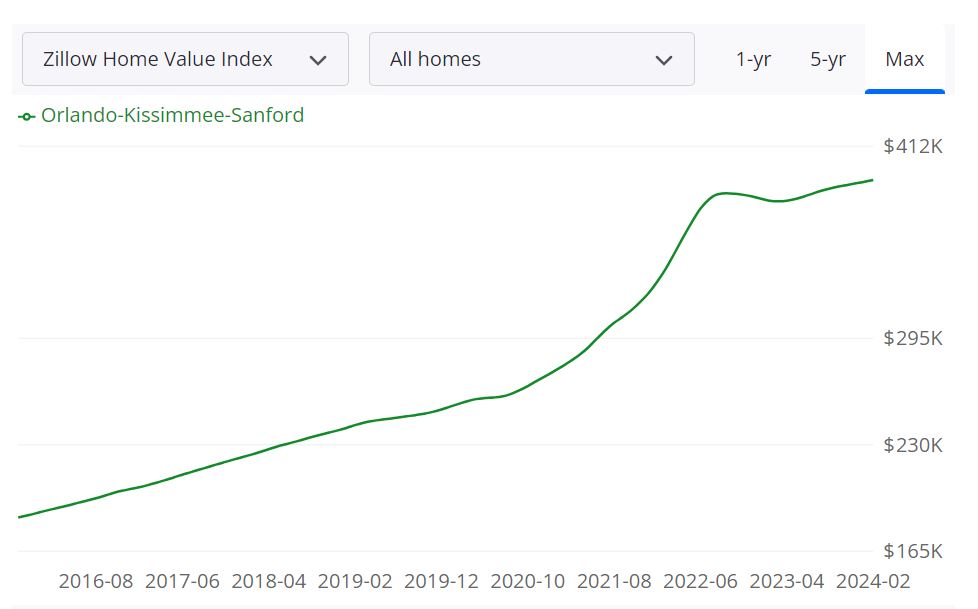

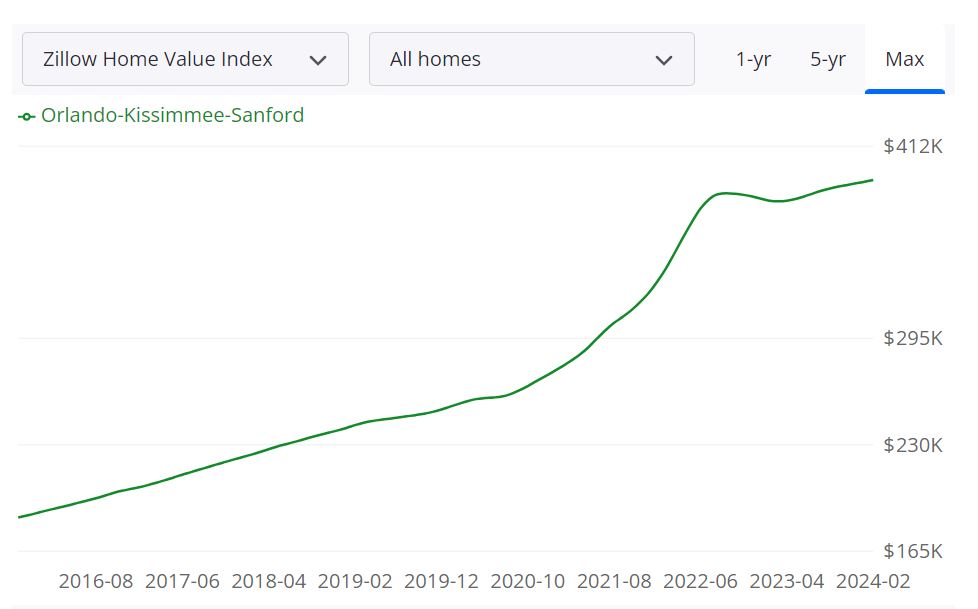

The Orlando housing market continues to show resilience and promise, with the average home value standing at $391,705, marking a 3.3% increase over the past year. According to Zillow, homes in this region typically go pending in approximately 30 days. Looking ahead, the market presents a 2.1% forecasted growth over the next year, based on data through February 28, 2024.

Key Metrics Explained

- For Sale Inventory: As of February 29, 2024, there were 11,025 properties listed for sale in the Orlando-Kissimmee-Sanford metropolitan area (MSA).

- New Listings: Over the same period, 3,100 new properties were listed for sale, indicating ongoing activity in the housing market.

- Median Sale to List Ratio: The median sale to list ratio, recorded as 0.980 as of January 31, 2024, reflects the relationship between the listed price of a property and its eventual selling price.

- Median Sale Price: As of January 31, 2024, the median sale price for homes in the Orlando area stood at $369,967.

- Median List Price: Looking at data through February 29, 2024, the median list price for properties in the region was $423,333.

- Percent of Sales Over and Under List Price: These metrics provide insights into market competitiveness. As of January 31, 2024, 13.6% of sales were above the list price, while 66.8% were below it.

The Orlando-Kissimmee-Sanford MSA encompasses several counties, including Orange, Seminole, Osceola, and Lake. With a diverse range of neighborhoods and communities, this metropolitan area boasts a sizable housing market, attracting both local residents and newcomers alike.

Are Home Prices Dropping in Orlando?

As of the latest data available, there are no indications of home prices dropping in the Orlando housing market. The median sale price of $369,967 as of January 31, 2024, coupled with a forecasted growth of 2.1% over the next year, suggests a stable or upward trajectory in pricing. However, market conditions can evolve, and it’s essential to monitor trends regularly for any shifts.

Will the Orlando Housing Market Crash?

While predicting market crashes with certainty is challenging, current indicators do not suggest an imminent crash in the Orlando housing market. Factors such as steady demand, limited inventory, and projected growth contribute to the market’s stability. However, external factors such as economic downturns or unforeseen events can impact market dynamics, highlighting the importance of cautious observation and risk management.

Is Now a Good Time to Buy a House in Orlando?

For individuals considering purchasing a home in the Orlando area, several factors should be weighed. With a balanced market and favorable mortgage rates, now could be a suitable time to buy for those with stable financial situations and long-term housing plans. However, it’s crucial to conduct thorough research, assess personal circumstances, and consult with real estate professionals to determine if it aligns with individual goals and objectives.

Orlando Real Estate Investment: Should You Invest in Orlando?

Is Orlando a Good Place Real Estate Investment? Many real estate investors have asked themselves if buying rental property in Orlando is a good investment. You need to drill deeper into local trends if you want to know what the market holds for the year ahead. We have already discussed the Orlando housing market 2024 forecast for answers on why to put resources into this market.

Let’s talk a bit about Orlando and the surrounding metro area before we discuss what lies ahead for investors and homebuyers. The City of Orlando is nicknamed “the City Beautiful and is one of the most-visited cities in the world primarily driven by tourism, major events, and convention traffic.

Orlando’s housing market is expanding at a great pace and people from all over the country and even beyond are either choosing to move permanently or invest here. Orlando has once again proved to be one of the best places to invest in real estate in Florida. Owing to its picturesque beaches, rapidly improving quality of life, booming population, and economy, Orlando is proving to be a secure real estate investment destination for not only local but also international investors.

Top Reasons To Invest In The Orlando Real Estate Market |

|

|

|

Let’s look at the number of positive things going on in the Orlando real estate market which can help investors keen to buy an investment property in this city.

Increasing Foreign Investment in Orland0

International investors from all major countries of the world are exhibiting their interest in the Orlando real estate market because of its beautiful scenery, improving quality of life, and ambient weather. It is also extremely popular for foreign investments because of its intercultural connectivity with people from various Latin American countries. In addition to this, many Chinese, as well as Spanish and Middle Eastern investors, are also attracted to Orlando, FL for real estate investment.

Dramatic Population Growth

Owing to people from various walks of life and demographic differences choosing to reside in the suburbs of Orlando, this city is going through major population growth. During the last 3 years, the population in Orlando has been growing at a rate of 7.2% which has never been experienced by this city before. The current population of Orlando in 2020 is 1,964,000, a 2.13% increase from 2019. The population of Orlando in 2019 was 1,923,000, a 2.18% increase from 2018.

Orlando is rapidly becoming a central attraction for businessmen, students, and small families owing to its growing trend of upward life mobility which makes lures investors to invest in the Orlando real estate market. Another reason for the growing economy and population expansion in Orlando, Florida, is the developed transportation infrastructure which makes traveling between destinations more convenient. Generally, Florida has an efficient transportation network that complements its tourism growth as well.

Orlando’s Increasing Job Opportunities

While improving the Orlando real estate market and flourishing tourism is two of the most important reasons behind Orlando’s economic stability, these two industries have a lot to gain from the successful economy. This expansion is related to the growing population and job opportunities in this city, this translates to more rental income and tourism leading to a better economy for the city. Orlando is the new hub for many young professionals especially those with various types of technological expertise, including engineers and IT professionals.

This city has experienced annual job growth of around 4.4% and is also one of the fastest-growing metro areas in the country. The city is also set to experience its highest job growth rate in the 10 years to come. A market with high job growth is a great market for real estate investment as well. Orlando metro area is adding STEM jobs at a faster clip than the Bay Area metros. The Orlando–Kissimmee–Sanford MSA was ranked among Forbes’ 15 Best Big Cities for Jobs. They cited Orlando’s science, technology, engineering, and mathematics (STEM) job growth in recent years as one contributing factor.

Orlando’s Rental Market

Thanks to a strong economy, Orlando’s rental market continues to boom. It is consistently named as one of the best rental markets in the nation and the #1 place in Florida to buy a profitable rental property. While tourism is one of the driving forces in the local economy, Orlando is also an important high-tech hub. Since job opportunities in Orlando are growing, people from all over the country and even some other countries are choosing to move here.

This directly translates to a boom in rental income as there is a resultant increase in the demand for both residential and commercial property rentals, and this means more steady income for investors in Orlando real estate market. The soaring rental rates are good signs for real estate investors. Around 46% of the households in Orlando, FL are renter-occupied.

Current Rental Market Trends

The average size for an Orlando, FL apartment is 962 square feet with studio apartments being the smallest and most affordable, 1-bedroom apartments are closer to the average, while 2-bedroom apartments and 3-bedroom apartments offer more generous square footage. About 60% of the apartments can be rented for $1,500/mo or less. 26% of the apartments fall in the price range of $1,501-$2,000, and only 8% are as expensive as $2,000/mo.

As of March 2024, the median rent for all bedroom counts and property types in Orlando, FL is $1,960. This is -2% lower than the national average. Rent prices for all bedroom counts and property types in Orlando, FL have remained the same in the last month and have decreased by 3% in the last year. The monthly rent for an apartment in Orlando, FL is $1,805. A 1-bedroom apartment in Orlando, FL costs about $1,659 on average, while a 2-bedroom apartment is $1,990. Houses for rent in Orlando, FL are more expensive, with an average monthly cost of $2,400.

Flexible Tax Laws

Investing in Orlando’s real estate market can help investors to lighten their taxes as Florida is one of the few states with no personal income tax. Its flexible tax laws are a blessing for investors, especially in this climate of a booming economy. Tax laws in Florida are considered to be the 4th friendliest laws in the country which is why a significant number of businesses choose to be based here.

Florida does impose a 5.5 percent corporate income tax. Orlando, owing to its friendly tax environment and affordable real estate can prove to be a vital opportunity for up-and-coming start-ups. Entrepreneurs and small business owners can rent showrooms and shops on better terms than most other cities and states.

Orlando is a Top-notch Tourism Center

Orlando has been boasting of economic stability since the beginning of the year 2018, and tourism growth and opportunities are some of the main reasons for its smooth expansion. Considered to be a “Theme-Park Capital of the World,” Orlando attracts most of its tourism due to the presence of Universal Studios as well as SeaWorld, and the most popular, Disneyland. In addition to this, Orlando’s beautiful beaches and warm weather also attract thousands of tourists every year.

Maybe you have done a bit of real estate investing in Florida but want to take things further and make it into more than a hobby on the side. It’s only wise to think about how you can and should be investing your money. In any property investment, cash flow is gold. Speaking about Orlando’s real estate market has a high potential for growth considering the current state of its economic expansion and population influx. This market currently has an ideal environment for US investors in housing properties, especially for turnkey real estate investments.

Good cash flow from Orlando rental property means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding the best investment property in Orlando in a growing neighborhood would be key to your success. When looking for real estate investment opportunities in Orlando or anywhere in the country, the generally accepted standard is to purchase a property that will give you a modest but minimum of 1% profit on your investment. An example would be: at $120,000 mortgage or investment cost, $1200 per month rental.

That would be the ideal equation for example. Even with rent increases, buying a $500,000 investment property in Orlando is not going to get you $5000 per month on rent. When looking for the best real estate investments in Orlando, you should focus on neighborhoods with relatively high population density and employment growth. Both of them translate into high demand for housing.

Here are the ten neighborhoods in Orlando having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Baldwin Park East

- Baldwin Park

- Southport / Lake Nona Estates

- Lake Fredrica North

- Azalea Park South

- Countryside

- Park Central

- Engelwood Park North

- Lake Buchanan

- Beacon Park

REFERENCES

Market Prices, Trends & Forecasts

https://www.orlandorealtors.org/marketreports

https://www.orlandorealtors.org/housingmarketnarrative

https://www.zillow.com/orlando-fl/home-values

https://www.redfin.com/city/13655/FL/Orlando/housing-market

https://www.neighborhoodscout.com/fl/orlando/real-estate

https://www.realtor.com/realestateandhomes-search/Orlando_FL/overview

Foreclosures

Reasons to Invest in Orlando Florida

https://www.thebalance.com/the-best-places-to-invest-in-real-estate-4163978

http://www.noradarealestate.com/blog/best-cities-to-invest-in-real-estate-in-2018

https://www.mashvisor.com/blog/orlando-real-estate-market-new-investors

https://www.lee-associates.com/centralflorida/2018/01/15/5-reasons-to-invest-in-central-florida

https://news.orlando.org/blog/orlando-leads-nation-in-job-growth-four-years-in-a-row/