This Florida real estate agent warns that the US ‘renters economy’ will destroy any retirement hopes for young Americans — here’s his math behind it

Being broke and struggling in your 20s used to be a rite of passage for college graduates. For many, it was a necessary stage to pass through right before you’d hit your stride in your 30s, steadily building a net worth you can

But many young people are finding the wealth they have managed to build up by their mid-careers isn’t affording them the kind of cushy lifestyle they’d expect — let alone allow them to dip a toe in real estate.

Don’t miss

And that’s got Orlando real estate agent Freddie Smith worried about what it means for this generation by the end of their careers.

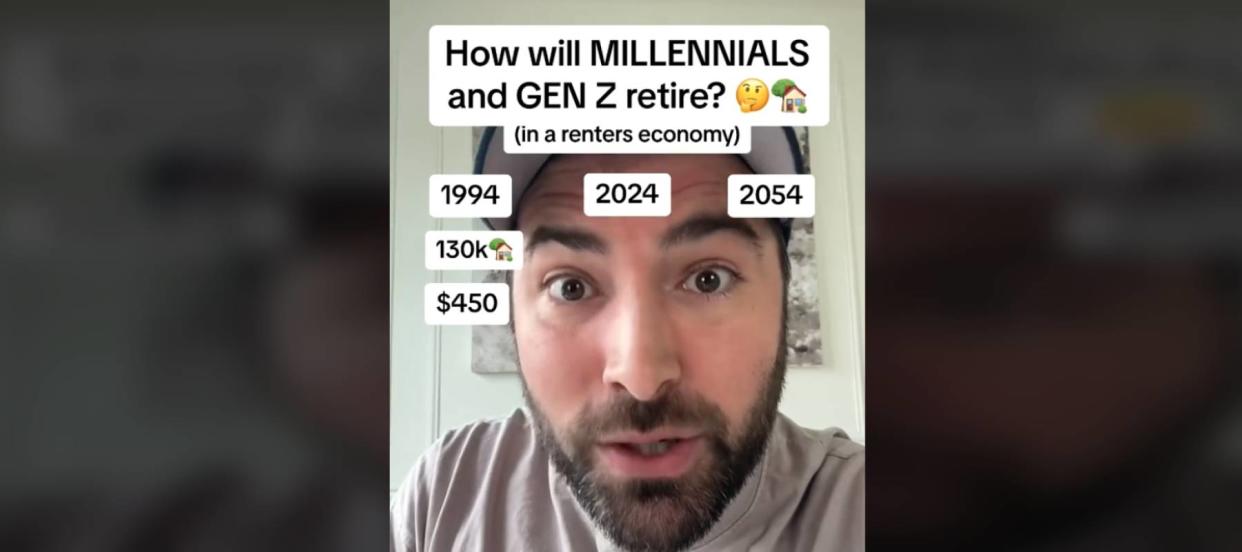

“My biggest concern with our country turning into a renters’ economy is: how will the millennial and Gen Zers retire comfortably if they don’t own a house and are going to have to rent forever?” he said in a recent TikTok.

Retirees in 2024 are already worried about their Social Security checks shrinking over the next decade. But Smith wonders if the next generation will even be able to retire at all.

The numbers don’t add up

Smith runs through the math of how he frets that the current high housing prices could jeopardize the next generations’ ability to retire.

Both Smith and the Federal Reserve find that the median price of a home in the U.S. is around $400,000 ($417,000, to be exact). But most young Americans can’t afford that these days.

At that price point, young Americans need to be prepared to put down $80,000 to hit the recommended 20% down payment. The Bureau of Labor Statistics reports that the median yearly earnings for 25- to 34-year-olds is $56,160 — which, with prices still elevated across the country, makes it hard to set aside the amount needed.

And so many young Americans turn to renting. Smith says renters nowadays are paying an average of $1,950 per month, which is close to the actual nationwide median rent cost of $1,964, according to Rent.com’s February 2024 report.

Here’s where Smith gets worried: He assumes that the home prices will continue to rise and young people will continue to rent well into their later years. But rent prices will also rise.

Smith shows the rent prices are 4.3 times higher in 2024 compared to 1994 ($1,950 per month in 2024, compared to the $450 per month in 1994), so he assumes that 30 years from now will see the same rent increase in 2054. That would mean that asking rents will likely have risen to around $8,500.

Smith knows that this number seems ridiculously high. But rents are already well over $4,000 in New York, according to Rent.com, so seeing it double in 30 years wouldn’t be out of the question.

And this is where the trouble lies. By 2054, the current crop of young people will be in their 50s and 60s. They’ll need a retirement plan.

“How do you retire if your rent’s going to be $8,500?” Smith asks.

Read more: Generating ‘passive income’ through real estate is the biggest myth in investing — but here’s 1 surefire way to do it with as little as $10

Retirement may not happen

For many people currently thinking about retirement, their home is a big part of their nest egg. Say they bought a home back in 1994, when the median home price was $130,000, according to the U.S. Department of Housing and Urban Development’s historical data.

In the decades since, the median home price has ballooned to $417,700, according to the Federal Reserve’s latest numbers, leaving many homeowners in the enviable position of being able to sell their homes for three times the price they originally paid.

But Smith points out that young people won’t have this option if they can’t afford to buy a home in the first place.

“This is a major concern,” he says. “How can you give the millennials and Gen Z and Gen Alpha hope about the future?”

What needs to change?

Smith blames institutional investors — such as hedge funds — for taking over the housing market and jacking up prices.

It’s true that investors bought up 28% of all single-family homes in the U.S. in September 2023, according to data analytics firm CoreLogic. The company expects this number to rise by 30% in the final quarter of 2023, but hasn’t reported their findings yet.

But you can’t solely blame investors for the housing crisis. Smith also wants to see “systems” put in place to help pave a path for retirement for younger generations.

He doesn’t elaborate on what he wants to see, but it sounds like he wants government intervention. Two pieces of legislation in recent years, first the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) in 2019 and the SECURE 2.0 Retirement Savings Act (SECURE Act 2.0) in late 2022.

Both bills include changes to retirement savings rules that aim to give average Americans a leg up in saving for retirement.

However, research has found one of the best tools for saving for retirement is through a workplace plan. And yet only about half of wage and salary workers in the U.S. have access to such a plan, according to analysis by the University of Pennsylvania. Some other workers still may have access to a plan, but fail to maximize it. If your employer offers 401(k) matching, keep in mind that extra bump each year is as close as it gets to free money — and if Smith’s worries come true, many working Americans can’t afford to pass up the extra cash.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.