Pensacola Housing Market Trends and Forecast for 2024

Given the current dynamics, Pensacola leans more towards being a buyer’s housing market. With prices down and homes spending a reasonable amount of time on the market, buyers have some room to negotiate and explore their options. However, sellers should not be discouraged, as homes still command a decent sale-to-list price ratio, and certain properties can attract competitive offers, especially those deemed “hot” in the market.

Pensacola, FL Housing Market Trends in 2024

How is the Housing Market Doing Currently?

As of February 2024, the Pensacola housing market has seen a decline in home prices, with a significant drop of 15.2% compared to the previous year. According to Redfin, the median price for homes in Pensacola stands at $280,000. On average, homes are spending approximately 77 days on the market, a slight improvement from 81 days recorded last year. However, the number of homes sold in February has decreased to 85, down from 123 in the same period last year.

How Competitive is the Pensacola Housing Market?

Pensacola’s housing market is not considered highly competitive. With homes selling in about 77.5 days on average, the market lacks the intensity seen in some other regions. Multiple offers on properties are rare occurrences, indicating a less aggressive buying environment. On average, homes are selling for around 4% below the list price, with the sale-to-list price ratio standing at 96.4%.

Are There Enough Homes for Sale to Meet Buyer Demand?

Currently, there seems to be a balance between the supply of homes for sale and buyer demand in Pensacola. While the market is not flooded with inventory, it also does not suffer from severe shortages. However, it’s worth noting that hot homes, those with high demand, can sell for around the list price and go pending in as little as 38 days, indicating pockets of heightened activity within certain segments of the market.

Looking ahead, the future market outlook for Pensacola remains uncertain. While the recent decrease in home prices might make the market more attractive to potential buyers, other factors such as economic conditions and local development projects can influence future trends. It’s essential for both buyers and sellers to stay informed about market changes and adapt their strategies accordingly.

Pensacola Housing Market Forecast for 2024 and 2025

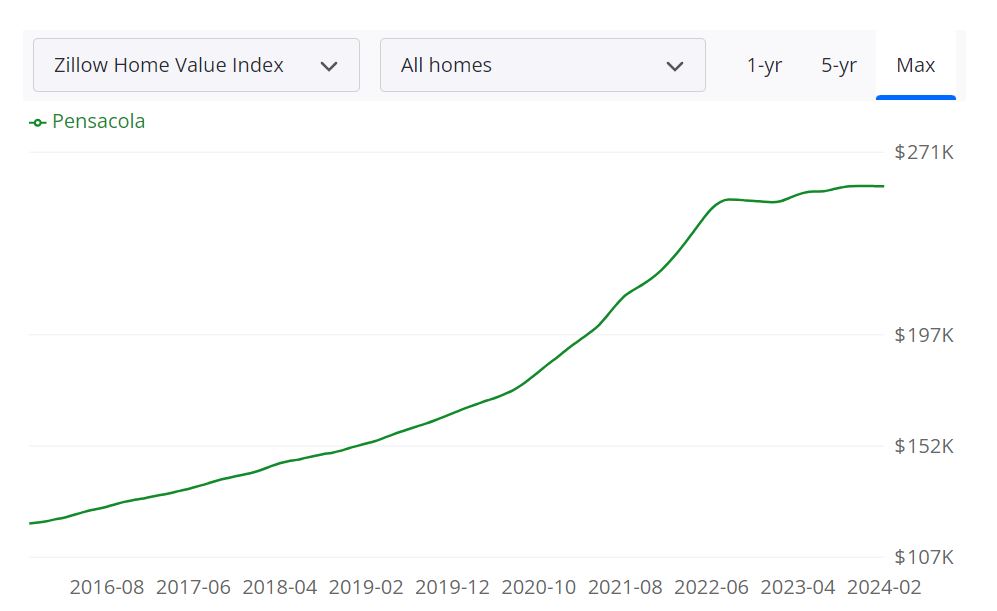

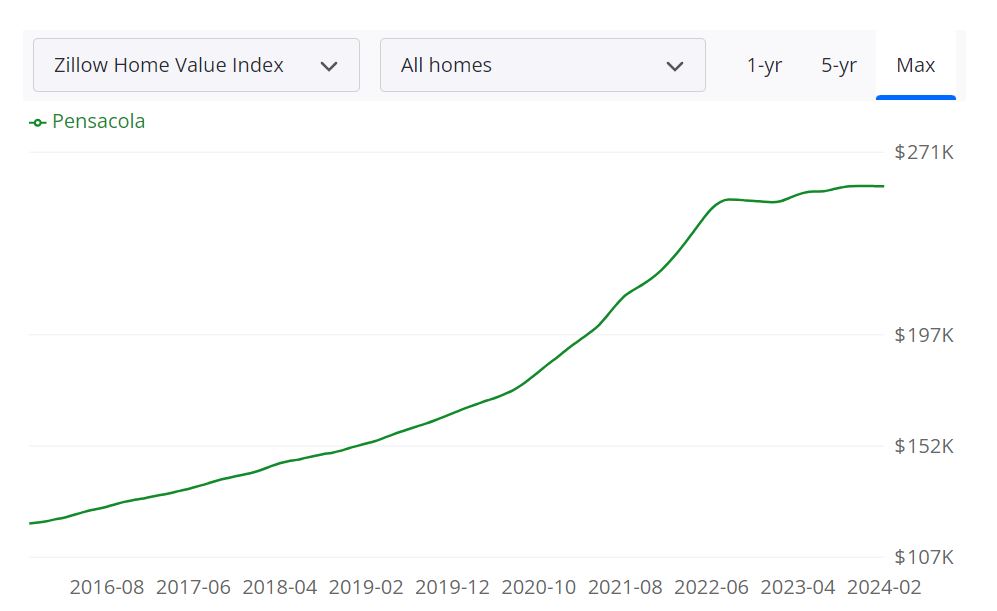

According to Zillow, the Pensacola housing market is currently experiencing a steady trajectory, with the average home value resting at $257,482, marking a 2.4% increase over the past year. Homes in this area typically go pending within approximately 34 days, indicative of a market with healthy demand. To grasp the nuances of this market, it’s essential to delve into key metrics and understand their implications.

Key Housing Metrics

For Sale Inventory: As of February 29, 2024, Pensacola boasts 1,421 homes for sale, indicating the breadth of options available to prospective buyers.

New Listings: Over the same period, 341 new listings have emerged, suggesting ongoing activity and a dynamic market.

Median Sale to List Ratio: The median sale to list ratio as of January 31, 2024, stands at 0.980, offering insight into the negotiation dynamics between buyers and sellers.

Median Sale Price: The median sale price, as of January 31, 2024, is $254,333, reflecting the average price at which homes are sold in the area.

Median List Price: Conversely, the median list price, as of February 29, 2024, is $301,667, providing a benchmark for sellers and agents alike.

Percent of Sales Over/Under List Price: These metrics reveal the competitiveness of the market. As of January 31, 2024, 17.7% of sales were recorded over list price, while 63.3% were under list price, indicating a varied landscape of negotiation and pricing strategies.

Pensacola MSA Housing Market Forecast

Looking ahead, the Pensacola Metropolitan Statistical Area (MSA) is poised for further growth. Defined by the U.S. Census Bureau, an MSA encompasses a core city and its surrounding communities with strong economic ties. In the case of Pensacola, this MSA includes various counties in Florida. The housing market within this MSA is substantial, underpinned by diverse neighborhoods and a range of property types catering to different demographics.

According to the forecast data provided, the Pensacola MSA is expected to see a 0.3% increase in housing market values by March 31, 2024, followed by a 0.8% rise by May 31, 2024. By February 28, 2025, the forecast predicts a more significant uptick of 2.6%, indicating sustained growth and investment potential.

Is Pensacola a Buyer’s or Seller’s Housing Market?

Assessing whether Pensacola’s housing market favors buyers or sellers requires a multifaceted analysis of supply, demand, and pricing trends. Currently, with 1,421 homes for sale and 341 new listings entering the market, buyers have a diverse array of options to explore. However, the median list price of $301,667 suggests a seller-friendly environment, indicating that demand may outpace supply in certain segments. Additionally, with 17.7% of sales recorded over list price, competition among buyers may further tilt the scale in favor of sellers. Overall, while buyers have choices, they may need to act swiftly and competitively to secure desired properties.

Are Home Prices Dropping in Pensacola?

Despite the nuanced dynamics of the Pensacola housing market, there is currently no indication of widespread price drops. The median sale price of $254,333 remains relatively stable, reflecting a consistent level of demand and seller confidence. While individual properties may experience fluctuations based on factors such as location, condition, and market trends, there is no overarching trend of declining home prices in the region.

Will the Pensacola Housing Market Crash?

Predicting a housing market crash requires a comprehensive understanding of economic factors, policy changes, and market sentiment, making it a challenging endeavor. While the Pensacola housing market exhibits fluctuations and varying levels of activity, there is no imminent sign of a crash. Market fundamentals such as population growth, employment opportunities, and affordability remain relatively robust, providing stability to the housing sector. However, it’s essential for buyers, sellers, and investors to remain vigilant and adapt to any shifts in market conditions.

Is Now a Good Time to Buy a House in Pensacola?

Determining whether now is a favorable time to buy a house in Pensacola depends on individual circumstances, goals, and financial readiness. With interest rates at lows as compared to last year and a diverse inventory of properties available, many buyers may find opportunities to secure their dream homes at competitive prices. However, it’s crucial to conduct thorough research, assess personal finances, and consider long-term objectives before making any decisions. Additionally, consulting with real estate professionals can provide valuable insights and guidance tailored to specific needs, ensuring a well-informed and advantageous home-buying experience.

Investing in the Pensacola Real Estate Market: A Comprehensive Analysis

1. Population Growth and Trends:

The population growth in Pensacola is a key factor contributing to the city’s real estate market attractiveness for investors. Consider the following:

- Steady Population Growth: Pensacola has experienced consistent population growth, driven by factors such as job opportunities, a vibrant economy, and a desirable living environment.

- Appeal to New Residents: The city’s allure to newcomers, including military personnel, government employees, and those seeking a coastal lifestyle, contributes to sustained demand for housing.

2. Economy and Jobs:

The economic landscape of Pensacola plays a crucial role in the real estate investment decision-making process:

- Diverse Economy: With a mix of military installations, government entities, and a growing tourism sector, Pensacola’s economy showcases diversity and resilience.

- Job Opportunities: The presence of military and government facilities creates a stable job market, attracting individuals seeking employment security, which positively impacts the demand for housing.

3. Livability and Other Factors:

Factors contributing to the overall livability of Pensacola can significantly influence the real estate market:

- Quality of Life: The city’s coastal location, cultural amenities, and outdoor activities enhance its overall appeal, making it an attractive destination for individuals and families looking for a high quality of life.

- Educational Institutions: Presence of reputable educational institutions contributes to the city’s attractiveness, influencing the decision-making of families and professionals considering relocation.

4. Rental Property Market Size and Growth:

For investors considering rental properties, the size and growth of the rental market in Pensacola are crucial factors to assess:

- Expanding Rental Market: With a growing population and an influx of new residents, the demand for rental properties is likely to increase, providing a potential avenue for investors to capitalize on a thriving rental market.

- Rental Yield Potential: The combination of a strong job market and an attractive living environment contributes to the potential for favorable rental yields, making Pensacola an enticing prospect for real estate investors.

5. Other Factors Related to Real Estate Investing:

Consider additional factors that can impact the success of real estate investments in Pensacola:

- Market Trends and Forecasts: Regularly monitor market trends and forecasts to stay informed about the trajectory of property values and rental rates, allowing for strategic investment decisions.

- Government Initiatives: Stay informed about local government initiatives and development projects that could positively impact property values or rental demand.

- Infrastructure Development: Assess ongoing and planned infrastructure projects, as they can influence property values and the overall desirability of certain neighborhoods.

References: